Price Gouging During the Covid-19 Pandemic: Questions for Socio-Economic Research

by Melike Arslan

Since the outbreak of the COVID-19 pandemic and the declaration of states of emergency around the world, the use of face masks, hand sanitizers, and other personal protective equipment (PPE) became not only recommended measures but also legally enforced requirements for going to work, taking public transportation, or entering to a grocery store. This created what economists call an “extreme shock” to the economic demand for those goods. As a result, PPE either disappeared from the market or were sold at exorbitant prices. According to one estimate, during April 2020, PPE prices increased by 1,000 percent on average in the US (Diaz, Sands, and Alesci 2020). From mid-January to March 2020, the 3M masks sold on Amazon by third-party vendors were on average 2.4 times more expensive than in 2019 (Cabral and Xu 2021). Similarly, on Amazon, the price of a box of disposable face masks (100 pcs) priced at roughly $10 before 2020 reached a whopping $120 in March 2020 (see Figure 1 below).

Figure 1: The price change in a sample of a box of disposable face masks (source: https://camelcamelcamel.com/product/B078718WVB)

Such price hikes were not only caused by increasing production costs and supply chain problems but also by the sellers’ newfound ability to sell their supply for any price.

One vendor, who sold nearly 10,000 medical masks on Amazon, explained to the press: “Even at $125 a box, they were selling almost instantly. It was mind-blowing what you could charge.” He estimated that he made nearly $40,000 in profit (Nicas 2020).

The concentration of high demand in urban areas and online marketplaces in particular created new opportunities for buying low and reselling high. In a now-infamous case, brothers Matt and Noah Colvin drove around Tennessee and Kentucky, buying thousands of bottles of hand sanitizer and other PPE from local stores to resell them on Amazon for exorbitant prices (Nicas 2020).

This type of seller behavior incited two kinds of reactions from society. On the one hand, there was denunciation, calling it “price gouging” and “profiteering” at the expense of vulnerable consumers during an emergency. Consumer advocacy groups, public agencies, and regulators commonly took this stance. For instance, on 25 March 2020, 33 Attorneys General warned Amazon and other online retailers about price gouging by third-party sellers and threatened sanctions (Oregon Department of Justice 2020). In response, Amazon removed over half a million product offers and suspended over 3,900 seller accounts (Amazon 2020). Yet, consumer advocacy groups continued to call on online retailers to “police themselves” and for “every state [to] pass anti–price gouging laws” in order to prevent sales of PPE for exorbitant prices (U.S. PIRG 2020). The federal government also issued an Executive Order creating the “COVID-19 Hoarding and Price Gouging Task Force” (Rydzewski 2020). These policy measures led to thousands of investigations, lawsuits, and regulatory orders on sellers. The Consumer Federation of America’s 2020 report found price gouging and other pandemic-related complaints among the “worst, fastest-growing, and new complaints” to consumer agencies around the country (CFA 2021).

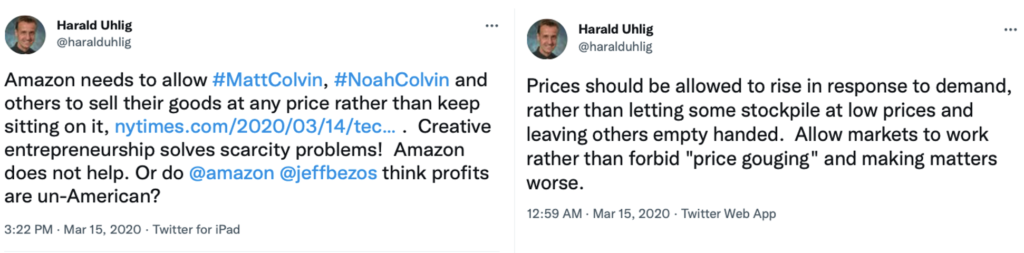

On the other hand, many economists defended price increases, arguing that they are not caused by the “immoral” deeds of “evil” sellers but increasing consumer demand and the relative scarcity of PPE during the pandemic. In fact, they claimed that raising prices served the common good by helping markets clear more efficiently. Economists argued that higher prices prevent hoarding by consumers and encourage the use of goods by those who need them most or for their most valued uses. Higher prices also contribute to the faster recovery of markets by incentivizing new market entries. Therefore, by punishing or shaming price increasing sellers, the regulators and consumer advocates actually harm consumer interests. For example, Professor Herald Uhlig from the University of Chicago, one of the most vocal supporters of allowing price increases during the pandemic, defended the Colvin brothers and urged Amazon to let them sell their products at any price (see his Tweets below). Uhlig was not alone in advocating for price increases under emergencies; a survey of economists in 2012 found that 77% of economists disapproved of the laws prohibiting price gouging (Henderson 2017).

Beyond engaging in the debate on whether increasing prices under emergencies is economically harmful or helpful, or whether it has normatively positive or negative ramifications, socio-economic research should also investigate how cultural norms configure markets through the debate over price gouging.

In normal times, sellers set their prices at the highest price possible without much moral condemnation, while there seems to be strong societal resistance to allowing such behavior following a disaster. Given the greater frequency of natural catastrophes like hurricanes or floods in the context of global climate change, price gouging will likely become an increasingly contested issue in market economies everywhere. However, political scientists and sociologists have mostly ignored the questions about the ethical and regulatory control of pricing decisions during emergencies. In particular, I identify three research questions for socio-economic scholarship:

- Why do consumers find price gouging morally indefensible? What moral frameworks and arguments motivate the condemnation of price increases during emergencies?

- Why are there public institutions (laws and regulations) prohibiting price gouging? And what explains the national variations among these institutions?

- Lastly, to what extent, if any, are the pricing decisions of sellers under emergencies informed by the moral denunciation (or the legal prohibition) of price gouging?

In the rest of this short piece, I will briefly explore these questions using recent research findings and drawing connections to some canonical works in the socio-economic scholarship.

1. Price Gouging and the Moral Economy

Issues relevant to the first question have been on the radar of the social sciences for a long time under the concepts of the moral economy and just price. Polanyi (1957) argued that perceptions of mutual obligation and reciprocity dominated market exchange under the Speenhamland poor relief system of 18th century England. Thompson (1971) showed that the existence of strong and popular beliefs about just grain prices motivated food riots during the same period. Scott (1977) demonstrated that the obligation of landlords to provide subsistence for their tenants was the main economic principle in peasant communities in Southeast Asia. However, in all these studies, such moral obligations are argued to have gradually disappeared against the advancement of the modern capitalist economy—for Thomson and Scott, due to the expansion and international linking of national markets, and for Polanyi, due to new laws and institutions. This led to the “disembedding” of market prices from social relations and norms (Polanyi 1957).

Yet, the vocal moral denunciation of price gouging during the COVID-19 pandemic, even in the most advanced economies, suggests that some of the cultural norms and expectations that defined moral markets have survived the expansion of free-market capitalism. Or, the moral economy exists side by side with the neoliberal economy in different areas, parts, or stages of economic production and circulation (see Carrier 2018).

Consumer advocates seem to have certain fair price expectations for some essential (non-luxury) goods and expect sellers to uphold their responsibility to provide for their customers’ needs instead of increasing their profits. For example, a spokesperson for a consumer advocacy organization explained, “It’s wrong for companies to engage in price gouging at a time when people have enough to worry about. We believe they can stop it and protect consumers at such a vulnerable moment” (Emma Horst-Martz in Hetrick 2020). Similarly, the Illinois Attorney General warned, “Now more than ever, it is crucial to put people before profits, and I will not hesitate to use my office’s authority to take decisive action against those that deliberately raise the prices of items that are crucial to stopping the spread of the coronavirus” (Illinois Attorney General 2020).

A few empirical studies have examined the complaints about price gouging and their motivations. In a now-famous study, Kahneman, Knetsch & Thaler (1986) performed phone surveys with the residents of two Canadian metropolitan areas (Toronto and Vancouver) and asked them about price hikes under various situations. They found that 82 percent of respondents considered raising the price of snow shovels in a snowstorm unfair. However, the study also showed that consumers reacted negatively to price hikes even in normal (non-emergency) times and for non-essential (luxury) goods.1 Thus, the authors concluded that consumers feel a general “entitlement to the terms of reference transactions”, i.e., some transaction that has occurred in the past, regardless of the circumstances (1986, 734). Furthermore, when consumers were presented with some explanations linking price hikes to supplier costs, they found price hikes fair. In a more recent experimental survey covering the COVID-19 pandemic, Buccafusco, Hemel & Talley (2021) found even more contradicting results: fewer than half of respondents said a supermarket raising the price of a bottle of hand sanitizer after the onset of the COVID-19 pandemic was being unfair (p. 4). Therefore, the existing evidence is unclear and even contradictory on how common the moral denunciation of price gouging is or the motivations behind this denunciation in different societies.

Besides the need for further empirical research, these contradictory findings also call attention to the potential changes in the moral conventions over price gouging. As Marion Fourcade underlines, “the sense of propriety is the product of relatively settled human struggles over the ontology of moral judgment” (2017, 667). The economists’ arguments on the ultimate morality of price gouging in providing allocative efficiency may, in the long run, change moral perceptions of price gouging if they have not done so already.

2. Institutions that Prohibit Price Gouging

This leads us to the second question about the institutions prohibiting price gouging. Tackling this question requires considering the power disparities and political processes that create anti-price gouging laws and regulations. Social scientists could look at, for example, whether the existence of strong consumer advocacy groups that can affect electoral outcomes is a strong predictor of price gouging restrictions. Another political-economic explanation could be the government’s position as the leading consumer of essential and scarce goods under emergencies to provide relief directly to disaster victims. However, it is also possible to argue that there is no social need for price gouging laws in contexts where social safety and welfare nets are strong or active during emergencies.

Only in political-economic contexts where such social safety nets are weak or missing can the moral duty of rescue be said to fall on private actors (e.g. Ripstein 2000).

This argument would be in line with the scholarship on the Varieties of Capitalism (VoC) (Hall and Soskice 2001) and the French regulation school (Amable 2003) that analyze the institutional varieties between different capitalist systems.

We can investigate these questions by examining the cross-national variations among the institutions prohibiting price gouging. Primarily, there are significant differences between the regulatory and antitrust (competition) law rules over price gouging. Competition law is primarily concerned with regulating the conduct of firms that enjoy market power, which is the ability to sustain the price above marginal cost. The EU Competition Law and the national competition laws of the EU member states prohibit high pricing by monopolists or oligopolists by the so-called excessive (or exploitative) pricing rule.2 While historically, this rule has been relatively underdeveloped and underused (Akman and Garrod 2011), its enforcement has increased in recent years (Kianzad 2020). Different nations relied on their competition laws during the pandemic to prevent price gouging over PPE and medical supplies. For example, the British, Italian, Greek, and Romanian competition authorities launched investigations into companies producing or importing PPE (OECD 2020). In a similar vein, the EU Commissioner for Competition, Margrethe Vestager, stated that “a crisis is not a shield against competition law enforcement” and that the European Commission “will stay even more vigilant than in normal times if there is a risk of virus-profiteering.”3

However, using competition laws to restrict price hikes during emergencies is challenging for governments. This extension of competition law rests on the assumption that competitive markets transform into monopolistic markets during emergencies (see Fung and Roberts 2021; Tucker 2021). When some retailers run out of stock or cannot restock their products under an emergency, the number of sellers with remaining supplies is suddenly much smaller, allowing them to charge monopoly prices. Furthermore, consumers’ ability to search for other supplies and shop around for better prices is significantly curtailed under an emergency, increasing the monopolistic power of local stores. For example, a recent report by the Center for Competition Policy in the UK shows that local convenience and drug stores sold PPE for substantially higher prices than the other national sellers (Fung and Roberts 2021, 25). However, establishing the collective increase in the monopoly power of sellers is empirically difficult and disputed by dominant economic theories. Furthermore, competition law actions take a long time to finalize in courts, and most of the time, the cases outlive the emergency situation from which they had stemmed. The fact that even some countries with the excessive pricing competition law rule (such as France) issued regulations on price gouging during the pandemic indicates the higher efficacy of price regulations in dealing with this problem.

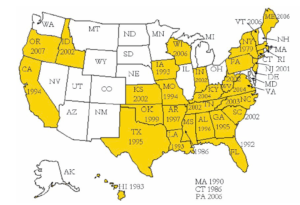

By contrast, the US antitrust laws do not have any excessive pricing rules prohibiting price increases by monopolists (likewise in Mexico, Canada, and Austria). Instead, almost all US states have some laws, executive orders, or ordinances that prohibit price increases when there is a declaration of emergency at the state level. While price regulations in the US have a long history, in the only historical study on state anti-price gouging laws, Davis (2008) finds that these laws were legislated fairly recently: the first law was passed by New York State in response to high oil prices in the winter of 1978-1979 (New York Assembly Bill 25, 1979), followed by Hawaii (1983), Connecticut (1986), and Mississippi (1986) (See Figure 2 below). Later, most states passed anti-price gouging laws either in 2002—in the aftermath of the 9/11 terrorist attacks—or in 2006 after Hurricane Katrina (Davis 2008, 32). While there is a clear association with the experience of some natural disasters, Davis found no correlation between the legislation of price gouging laws and the average income, income dispersion, and the political party affiliation of states (2008, 32).

Figure 2: Map of states with anti-price gouging laws before 2008 with year of legislation (source: Davis 2008, 25)

There are also important variations across state anti-price gouging laws in the US (Bae 2009). Some states allow for a certain percentage of price increase beyond pre-emergency levels (ranging between 10 and 25 percent) (7 states) and others outright prohibit any increase in prices (7 states). Most states (16) more ambiguously prohibit “unconscionable” increases in price. This latter category is the most difficult to enforce since it is left to the state courts and consumer authorities to determine what constitutes an unconscionable price increase in each situation and sellers can use the ambiguity in the language of the law to refuse responsibility (Bae 2009). Future research could explore such variations in the text of price gouging laws within the US, in addition to the variations between the competition law prohibitions of the EU and the regulatory rules in the US, to understand how the institutions that prohibit price gouging came about and how they are put into practice.

3. Price Gouging and Market Morality

Lastly, most of the discussion over the moral and legal permissibility of price gouging is based on assumptions of the motivations and behaviors of sellers during an emergency. Those who oppose price gouging suggest that the sellers intentionally and maliciously abuse and profiteer from a dire situation. Economists, instead, assume that sellers are simply pursuing their economic self-interests, in the fashion described by Adam Smith (“It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own interest” (Smith 2010 [1776], 18)).

However, we know very little about sellers’ pricing decisions and economic motivations during an emergency and whether the moral norms over price gouging influence these decisions.

The sticky price theory in economics suggests that, contrary to expectations, sellers either keep their prices stable or drop their prices during an emergency. Disputing Adam Smith, Julio Rotemberg argues that consumers care deeply about the “benevolence” of sellers; when they observe that a seller does not evince this benevolence, especially under an emergency, they punish them by shopping elsewhere the next time (2003). He suggests that when consumers encounter price hikes, they feel an intense “regret” for not having bought the goods earlier. Since firms expect this regret to negatively affect their long-term success, they forego profits or even suffer short-term economic losses by keeping prices stable (2008). Therefore, Rotemberg concludes that even in the absence of price gouging laws, price increases that are supposed to achieve allocative efficiency do not occur (2008, 27). Indeed, empirical research has found no evidence of widespread price increases during prior emergencies and even found declining prices in some cases (Neilson 2009; Cavallo, Cavallo, and Rigobon 2014; Beatty, Lade, and Shimshack 2021). These findings are also consistent with the existing surveys with businesses (Blinder et al. 1998). Especially sellers with “high levels of reputation”, such as national retailers like Amazon, have higher stakes in seeming “benevolent” during an emergency (Cabral and Xu 2021). However, like Adam Smith, Rotemberg and other economists studying sticky prices conceptualize sellers as profit-maximizing agents, who act benevolently only because it is in their economic interests.

While Polanyi, Thompson, and Scott emphasize the contradictions between moral expectations and the logic of modern capitalism in their works on the moral economy (Fourcade 2017, 662), more recent works on market morality instead find that modern markets are “saturated with normativity” (Fourcade and Healy 2007, 299). Rather than rejecting or fighting against moral norms, market actors internalize and refashion them for their ends. For example, Zelizer demonstrates that the moral framing of life insurance as a transaction that serves to protect ones’ family’s well-being after one’s death helped create the life insurance industry (Zelizer 1978). Building on this work, Healy argues that procurement organizations have used a cultural account of gift-giving to make organ and blood transactions more acceptable (Healy 2004). Similarly, Quinn accounts for the emergence of the secondary market in life insurance through the moral narratives that present life insurance policies to investors to ensure a dignified death for the poor and the terminally ill (Quinn 2008). Based on these works, future research could investigate how the existing social norms over price gouging are already shaping the pricing decisions of sellers during emergencies, and how sellers also mold the moral frameworks over price gouging through their business practices.

Conclusion

In this short piece, I have tried to call attention to the subject of price gouging during emergencies and suggested three research questions the socio-economic scholarship could address. The issue is likely to be increasingly discussed and contested by businesses and regulators in the future as global health and environmental emergencies are expected with increasing frequency. As I tried to show, the socio-economics scholarship has much to offer to this discussion. And in turn, understanding the denunciations, restrictions, and economic behaviors related to price gouging can help social scientists improve their existing theories on markets, institutions, and moral norms.

[1] For example, a $200 increase in the price of a popular automobile model when there is a shortage in supply was also perceived as unfair by 71 percent of respondents (Kahneman, Knetsch & Thaler 1986, p. 732).

[2] The Treaty on the Functioning of the European Union (TFEU) Article 102 provides that an abuse of monopoly power may consist of “directly or indirectly imposing unfair purchase or selling prices or other unfair trading conditions”.

[3] https://www.clearygottlieb.com/news-and-insights/publication-listing/exploitative-abuse-of-dominance-and-price-gouging-in-times-of-crisis.

Bibliography

Akman, Pinar, and Luke Garrod (2011) “When Are Excessive Prices Unfair?” Journal of Competition Law & Economics 7 (2): 403–26.

Amable, Bruno (2003) The Diversity of Modern Capitalism. Oxford University Press on Demand.

Amazon (2020) “Price Gouging Has No Place in Our Stores.” March 24, 2020. https://www.aboutamazon.com/news/company-news/price-gouging-has-no-place-in-our-stores.

Bae, Emily (2009) “Are Anti-Price Gouging Legislations Effective Against Sellers During Disasters.” Entrepreneurial Bus. LJ 4: 79.

Beatty, Timothy KM, Gabriel E. Lade, and Jay Shimshack (2021) “Hurricanes and Gasoline Price Gouging.” Journal of the Association of Environmental and Resource Economists 8 (2): 347–74.

Blinder, Alan, Elie RD Canetti, David E. Lebow, and Jeremy B. Rudd (1998) Asking about Prices: A New Approach to Understanding Price Stickiness. Russell Sage Foundation.

Buccafusco, Christopher, Daniel J. Hemel, and Eric L. Talley (2021) “Price Gouging in a Pandemic.” Available at SSRN.

Cabral, Luis, and Lei Xu (2021) “Seller Reputation and Price Gouging: Evidence from the COVID-19 Pandemic.” Economic Inquiry 59 (3): 867–79.

Carrier, James G. (2018) “Moral Economy: What’s in a Name.” Anthropological Theory 18 (1): 18–35.

Cavallo, Alberto, Eduardo Cavallo, and Roberto Rigobon (2014) “Prices and Supply Disruptions during Natural Disasters.” Review of Income and Wealth 60: S449–71.

CFA, Consumer Federation of America (2021) “2020 Consumer Complaints Report.” https://consumerfed.org/reports/2020-consumer-complaint-survey-report/.

Davis, Cale Wren (2008) “An Analysis of the Enactment of Anti-Price Gouging Laws.” PhD Thesis, Montana State University-Bozeman, College of Agriculture.

Diaz, Daniella, Geneva Sands, and Cristina Alesci (2020) “Protective Equipment Costs Increase Over 1,000% amid Competition and Surge in Demand,” April 17, 2020, sec. CNNPolitics. https://edition.cnn.com/2020/04/16/politics/ppe-price-costs-rising-economy-personal-protective-equipment/index.html.

Fourcade, Marion (2017) “The Fly and the Cookie: Alignment and Unhingement in 21st-Century Capitalism.” Socio-Economic Review 15 (3): 661–78.

Fourcade, Marion, and Kieran Healy (2007) “Moral Views of Market Society.” Annual Review of Sociology 33.

Fung, San Sau, and Simon Roberts (2021) “The Economics of Potential Price Gouging during Covid-19 and the Application to Complaints Received by the CMA.” Centre for Competition Policy, University of East Anglia, Norwich, UK.

Hall, Peter A., and David Soskice (2001) “An Introduction to Varieties of Capitalism.” Op. Cit, 21–27.

Healy, Kieran (2004) “Altruism as an Organizational Problem: The Case of Organ Procurement.” American Sociological Review 69 (3): 387–404.

Henderson, David (2017) “A Poll of Economists on Price Gouging.” EconLog (blog). September 15, 2017. https://www.econlib.org/archives/2017/09/a_poll_of_econo.html.

Hetrick, Christian (2020) “Coronavirus Has Consumers Making an ‘Extraordinary’ Number of Price Gouging Complaints.” The Philadelphia Inquirer, April 29, 2020. https://www.inquirer.com/consumer/coronavirus-price-gouging-complaints-pa-nj-20200429.html.

Illinois Attorney General (2020) “Attorney General Raoul Will Take Action to Stop Price Gouging On Items Related To The Coronavirus.” https://illinoisattorneygeneral.gov/pressroom/2020_03/20200317b.html.

Kahneman, Daniel, Jack L. Knetsch, and Richard Thaler (1986) “Fairness as a Constraint on Profit Seeking: Entitlements in the Market.” The American Economic Review, 728–41.

Kianzad, Behrang (2020) “The Giant Awakens-Law and Economics of Excessive Pricing & COVID-19 Crisis.” Available at SSRN 3706793.

Neilson, Henry (2009.) “Price Gouging versus Price Reduction in Retail Gasoline Markets during Hurricane Rita.” Economics Letters 105 (1): 11–13.

Nicas, Jack (2020) “He Has 17,700 Bottles of Hand Sanitizer and Nowhere to Sell Them.” The New York Times, March 14, 2020. https://www.nytimes.com/2020/03/14/technology/coronavirus-purell-wipes-amazon-sellers.html.

OECD (2020) “Exploitative Pricing in the Time of COVID-19.” Tackling Coronovirus (COVID-19): Contributing to a Global Effort. https://www.oecd.org/competition/Exploitative-pricing-in-the-time-of-COVID-19.pdf.

Polanyi, Karl (1957) The Great Transformation:(The Political and Economic Origin of Our Time). Beacon Press.

Quinn, Sarah (2008) “The Transformation of Morals in Markets: Death, Benefits, and the Exchange of Life Insurance Policies.” American Journal of Sociology 114 (3): 738–80.

Ripstein, Arthur (2000) “Three Duties to Rescue: Moral, Civil, and Criminal.” Law and Philosophy, 751–79.

Rotemberg, Julio J. (2003) “The Benevolence of the Baker: Fair Pricing under Threat of Customer Anger.” Manuscript, Harvard Business School, Cambridge, MA.

——— (2008) “Behavioral Aspects of Price Setting, and Their Policy Implications.” National Bureau of Economic Research.

Rydzewski, Marissa (2020) “Price Gouging during a Pandemic: The Federal Government’s Response.” DttP 48: 33.

Scott, James C. (1977) The Moral Economy of the Peasant: Rebellion and Subsistence in Southeast Asia. Vol. 315. Yale University Press.

Smith, Adam (2010) The Wealth of Nations: An Inquiry into the Nature and Causes of the Wealth of Nations. Harriman House Limited.

The Oregon Department of Justice (2020) “33 Attorneys General Warn Amazon, Facebook, Ebay, Craigslist: You Aren’t Exempt from Price Gouging Laws.” Consumer Protection, Media Release. https://www.doj.state.or.us/media-home/news-media-releases/33-attorneys-general-warn-amazon-facebook-ebay-craigslist-you-arent-exempt-from-price-gouging-laws/.

Thompson, Edward P. (1971) “The Moral Economy of the English Crowd in the Eighteenth Century.” Past & Present, no. 50: 76–136.

Tucker, Todd (2021) “Price Controls: How the US Has Used Them and How They Can Help Shape Industries.” Roosevelt Institute. November 16, 2021. https://rooseveltinstitute.org/publications/price-controls-how-the-us-has-used-them-and-how-they-can-help-shape-industries/.

U.S. PIRG, US Public Interest Research Groups (2020) “Six Months into the COVID-19 Pandemic, Price Gouging Persists on Amazon.” https://uspirg.org/news/usf/six-months-covid-19-pandemic-price-gouging-persists-amazon.

Zelizer, Viviana A. (1978) “Human Values and the Market: The Case of Life Insurance and Death in 19th-Century America.” American Journal of Sociology 84 (3): 591–610.

——— (1989) “The Social Meaning of Money:” Special Monies”.” American Journal of Sociology 95 (2): 342–77.