Inflation: A new window of opportunity for labor bargaining?

by Joshua Cova (Max Planck Institute for the Study of Societies)

Introduction

With inflation rates peaking at 9% in the US, 11% in the UK, 10.6% in the Eurozone in 2022, numerous strikes and lockouts across countries and economic sectors as well as wars raging in Eastern Europe and the Middle East, one would be forgiven for thinking that these past years have brought us back to problems that had been thought of as belonging to a different era. For decades, policymakers and economists have claimed with flamboyant confidence that inflation could be treated as a purely technical monetary problem, caused by too much demand chasing too few goods; the solution thus lay in simply altering the interest rate so as to reduce the money supply in the economy. Trade unions, weakened by decades of deregulatory labor market reforms, globalization, offshoring, and outsourcing, as well as by the difficulty of adapting to increasingly heterogeneous, service-led economies embarked – seemingly ineluctably – upon a path of irreversible decline. However, as inflation rates have started to climb down from the highs they had attained in the past two years, it is worth reflecting on what changes the recent bout of inflationary pressures have brought about for the role that social actors play in the labor market. In this piece, I examine what this recent period of inflation might mean for industrial relations and collective bargaining across advanced economies, against a backdrop of real wage stagnation, inflation, and tight labor markets, as well as a series of high-profile labor disputes in a number of countries. I will argue that after decades of union decline, government policy will play a key role in ensuring that collective bargaining and industrial relations institutions are equipped with the necessary tools to ensure that workers’ purchasing power is maintained during a time of higher inflation rates. Considering the distributional nature of inflation, which tends to affect low-income households more than households in the upper deciles of income distribution, the analysis of the relationship between industrial relations systems and inflation is important for researchers interested in socio-economics. I first examine the way in which this recent increase in inflationary dynamics has been conceptualized by policymakers and economists; this will lead me to discuss fiscal stimuli and wage-price spirals, as well as the more novel notion of sellers’ inflation. Following this, I examine how inflation and the concomitant erosion in workers’ purchasing power has led to growing industrial conflict in the US and in Europe and discuss what this might mean for our understanding of the distributional nature of inflation. Lastly, I conclude with some thoughts on how government policy can help social actors and collective bargaining institutions in ensuring that the purchasing power of workers does not become systematically eroded by inflation developments.

Understanding inflation: The usual explanations and new interpretations

The recent surge in inflationary dynamics has led to a critical reassessment of the causes of inflation. While some arguments ring very “familiar,” other studies have framed inflation in an alternative way. As far as the immediate causes of the recent inflationary pressures witnessed by different economies in 2022-2023 are concerned, there seems to be widespread consensus in seeing the supply shocks engendered by the COVID pandemic and Russia’s war of aggression against Ukraine as root causes. Nevertheless, analysts and policymakers have often noted that the extent to which exogenous inflationary shocks reverberate within countries’ economies is contingent upon a set of country-specific factors. Unsurprisingly, this also means that assessments of the reasons for inflation are colored by ideological interpretations. In what follows, I examine some of the most “popular” current explanations for inflation, which I identify in 1) post-COVID government spending, 2) labor market institutions’ rigidities and the incidence of wage-price spirals, and 3) the more novel idea of sellers’ inflation, which holds that corporations exploit supply bottlenecks to increase prices (and thus the inflation rate). These different interpretive lenses through which to conceptualize inflation will provide the backdrop against which I will examine the extent to which this inflationary episode can provide an opportunity for an institutional revival of the role of industrial relations and social actors in the labor market.

At its core, inflation has often been said to exist when the supply of money in an economy is too high. As governments and central banks are responsible for the money supply, scholars and analysts have studied the way in which sudden and increased government spending can have negative inflation externalities. Recently, much attention has been paid to the role that government spending during the COVID pandemic has had in increasing inflation. Government largesse in the form of pandemic relief checks and job retention schemes has increased consumer spending on goods, which – in a time of COVID-induced global supply bottlenecks – has led to higher prices, according to some empirical research. However, looking at the past, other researchers have been more cautious in linking government spending to higher inflation. Despite leading to increases in the money supply, massive programs of quantitative easing on the part of central banks or multi-billion dollar stimulus packages implemented by governments in the aftermath of the 2008-09 global financial crisis did not usher in a period of inflation. It is also worth noting that while for most countries the pandemic has coincided with a period of greater government spending, not all countries have witnessed double-digit inflation rates (e.g., Japan, Switzerland).

Historically, in addition to government spending, policymakers and analysts have often also homed in on rigid labor market institutions and the incidence of wage-price spirals as a second potential culprit for higher inflation rates. Indeed, in the past decades, research on inflation has very much been informed by the view that in order to understand the persistence of inflationary dynamics, it is important to examine the presence of different types of labor market institutions. Economic research has tied labor markets with high employment protection and high unionization rates to higher inflation. This is because strong labor market institutions can tie wage growth to inflation developments and this can then give rise to wage-price spirals (Bowdler and Nunziata, 2007; Campolmi and Faia, 2011; Jaumotte and Morsy, 2012). Recent research and policy statements, however, illustrate that the debate on the inflationary dynamics of wage growth is far from settled and remains highly ideological and politicized. While Philip Lane, chief economist of the ECB, warned that “wage inflation will be a primary driver of price inflation over the next several years” and Andrew Bailey, Governor of the Bank of England, cautioned workers to stop demanding higher pay, the International Monetary Fund (IMF) has, in a recent policy paper, found little historical evidence of wage-price spirals (Alvarez et al., 2022). Moreover, as noted by the Economic Policy Institute, while wage-price spirals may always constitute a theoretical possibility, their existence is completely dependent upon the institutional context in which wage bargaining occurs. If the structural and organizational power of workers and employees is weakened, then it is unlikely that workers will be able to systematically pass through wage demands that would lead to the onset of a wage-price spiral. To understand the nature of inflationary dynamics, it is therefore crucial to examine the strength and resilience of social actors and labor market institutions (a point to which I will return later on).

Along with government spending and labor market institutions, a relatively new explanation for inflation has emerged thanks to the recent work of Isabella Weber, who has caused global furor among mainstream economists for arguing that corporate profits might well be responsible for exacerbating existing inflationary pressures. By recognizing that inflation is made up by profits as well as by costs, Weber has homed in on the former part of the “inflation formula” and has compellingly illustrated the extent to which firms exploit supply bottlenecks and increase prices for consumers (Weber and Wasner, 2023). While maligned by mainstream economists at the beginning, with critics pillorying her idea of strategic price controls, the idea of sellers’ inflation has progressively taken hold in policymaking circles. Indeed, as testified by numerous policy reports issued by central banks and international economic organizations, the idea of a sellers’ inflation is no longer considered taboo, as there is increasing evidence of sellers’ inflation in different economic sectors and countries.

Workers’ demand and the recent mobilization in reaction to inflation in the US and Europe

In economic terms, it is not only high inflation that has set the past two years apart from the past decades, but also the growing number of strikes, which have rattled the long period of “low industrial conflict” witnessed by advanced economies since the 1990s. Indeed, the increasing levels of conflict between workers and employers have even led some commenters to talk about a “summer of discontent” in the UK or a “hot labor summer” in the US, and highly publicized strikes such as the Hollywood writers’ strike and the United Auto Workers’ (UAW) strike have captured global attention. More recently, in October 2023, the US has experienced what has been referred to as the largest walkout of its healthcare workers on record. All in all, as summarized by Art Wheaton from Cornell University, “it’s been a good year for unions.” Although the US labor market has been liberalized much more than that of European countries in the past decades, industrial action and demands to align wage growth to inflation developments have also affected the largest European economies. To this effect, one may note the wide-ranging strikes in the public education and healthcare sectors in the UK or the transport services strikes that have periodically affected Germany in the last years.

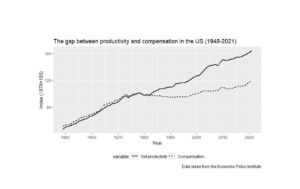

While the motivation for every industrial action is of course determined by a set of unique company, sector, and country-specific characteristics, in this piece, I intend to focus on inflation and the loss of purchasing power as a common theme connecting many of the strikes, which have perturbed different economies. The need to align wage demands to inflation growth is clear if one examines, for example, the demands made by the UAW in their ongoing strike, which have taken the form of a push for a 40% wage increase. At a time of rising inflation and soaring corporate profits, pay for workers employed in the American automotive industry has simply not kept up. While corporate profits at the big 3 carmakers (GM, Ford and Stellantis) have increased by a whopping 92% between 2013 and 2022, median compensation for workers in the automotive sector has fallen in real terms by 19% since 2008, according to data from the Bureau of Labor Statistics – a fact that President Biden pithily summarized when he recently told striking auto workers “you’ve earned a hell of a lot more than you’re getting paid now.” Although labor unions and workers have frequently highlighted the yawning chasm that has formed between growth in executive pay and developments in the median compensation of workers, the recent cost-of-living crisis has made these pay differentials worse and has led to growing demands on the part of workers to ensure that their purchasing power is maintained. The connection between this strike and inflation is clear if we consider that the strike has also focused on re-inserting a cost-of-living adjustment (COLA) clause to the work agreement; this was a provision that the union gave up at the time of the 2008-09 financial crisis, when inflation seemed to be a distant problem and workers were more worried about the prospect of unemployment and plant closures. Moreover, the wage negotiations between unions and car manufacturers have not only occurred against the backdrop of the enormous profits made by car companies, but have also occurred at the heels of a time marked by income stagnation for large swathes of the population. As illustrated in the chart below, evidence shows that wage growth in the US has clearly fallen behind productivity growth in the past decades, a phenomenon that Erik Brynjolfsson and Andrew McAfee have referred to as “The Great Decoupling” (2013).

Figure 1: US Bureau of Labor Statistics and Bureau of Economic Analysis (EPI analysis)

This phenomenon, however, is not only unique to the US – wages have stagnated across many advanced economies and, in Europe in particular, workers have experienced a significant loss in purchasing power as real wages have decreased significantly since the financial crisis and even more so since the pandemic. Real wages in the EU in 2022 have fallen by 4% in real terms and evidence in the UK shows that real wage growth in the 2010s has grown at its slowest rate since the Napoleonic wars.

Against this backdrop of real wage stagnation, it is worth reflecting on the consequences these strikes have had. Indeed, what is surprising about the recent wave of industrial action that swept across the US is not so much that these strikes have happened, but rather that, for the most part, they have been so successful. The successes recorded by striking workers as well as the series of high-profile unionization initiatives across US firms suggest that trade unions in the US are increasingly becoming a force to be reckoned with. While surveys in the US register an increase in the trust that workers have in unions, the National Labor Relations Board has made it increasingly difficult for US companies to thwart unionization drives or penalize unionized workers. The historic decision of President Biden, the self-declared “most pro-union president in US history,” to join the UAW’s picket line in order to show his support for workers’ demand for cost-of-living adjustments, might be symbolic and likely informed by the need to fight for the vote of blue-collar workers in the upcoming presidential election, but it remains significant nevertheless. To summarize, the successes that unions have recently registered in the US – a country that has been hostile to unionization drives over the past decades – can, broadly speaking, be chalked up to a series of political and economic reasons. Tight labor markets, low unemployment, and high vacancies have allowed social actors to bargain out of a position of strength and press on their demand to align wage growth to inflation developments. However, the successes registered by organized labor would not have been possible had it not been for the supportive environment that has been created for unions, which is made up by public as well as political support.

What now?

In this piece I have focused on the way in which the erosion of workers’ purchasing power, which has been a consequence of the recent inflationary spike witnessed by different economies, has led to a reassessment of how labor bargaining can ensure that real wage growth is kept in line with developments in inflation. Now, what can government policy do to ensure that unions and collective bargaining institutions are equipped with the right set of tools to shield workers from future losses in their purchasing power? To mitigate the negative repercussions of inflation, it is insufficient to look at labor unions alone; indeed, at the heels of a decades-long period of significant union decline, the role of government policy in supporting the institutional power of social actors in maintaining workers’ purchasing power is likely to be crucial. Although some policymakers have warned about the prospect of wage-price spirals, it is important to note that politicians are also likely to be very aware of the electoral repercussions of cost-of-living crises.

I would like to argue that the role of the state in enhancing the power of unions and collective bargaining institutions in the labor market needs to go beyond elected officials publicly supporting unionization drives – it needs to crystallize around concrete legislation proposals. This can be done, for example, by tying subsidies or public procurement tenders to adequate working conditions. Concrete applications of this include awarding large-scale constructions projects with federal contracts to project labor agreements (pre-hire collective bargaining agreements) as in the US and tying public procurement tenders to collective bargaining agreements, as laid out in a German draft bill published this year, which was introduced with the explicit objective of increasing collective bargaining coverage rates. Furthermore, the recent EU Minimum Wage Directive (2022) not only requires member states with statutory minimum wages to index minimum wage growth to inflation developments, but also calls on member states to lay out national action plans to ensure that collective bargaining coverage rates come to include 80% of the workforce. More generally, the potential role that the state plays in ensuring the adequate compensation of workers is clear when considering the introduction of job retention schemes, which were also introduced in liberalized labor markets such as the US and the UK, and which helped to prevent the possibility of significant losses in purchasing power at the height of the COVID crisis.

Moreover, possibly aware of the wealth of academic research that has linked higher union density rates and higher collective bargaining coverage rates to lower levels of economic inequality (OECD, 2019; Keune, 2021), there are numerous examples of different governments and international organizations that have recently sought to recommend labor market policies that move policymaking into an increasingly social direction. As several analyses have clarified, income inequality and real wage stagnation also have consequences for the many voters and workers who feel left behind by the changes engendered by globalization and have therefore become disillusioned with the existing political order. Recent events lead us to conclude that the role that social actors and collective bargaining institutions play in maintaining adequate working conditions and pay levels will become progressively more important in ensuring that economic growth becomes more equitable and that workers are shielded from the costs of high inflation.

In this piece, I have sought to spotlight some of the different explanations for the recent high inflation witnessed by a number of economies. I have also underlined that inflation has clear distributional dimensions – workers, whose spending patterns are not as elastic as those in the upper deciles of the income distribution, are likely to be more dependent on institutional actors, such as trade unions and collective bargaining institutions, in ensuring that their economic concerns do not fall by the wayside. I have concluded by noting that government policy is likely to play a key role in ensuring that social actors and labor market institutions are provided with the adequate tools to help workers maintain their purchasing power. The next years will indicate the extent to which this inflationary episode has laid the foundation for a revitalization of unions in inflation and worker-employer relations.

References

Alvarez, J., Bluedorn, J., Bluedorn, M. J., Hansen, M. N.-J., Hansen, N.-J., Huang, Y., . . . Sollaci, A. (2022). Wage-price spirals: What is the historical evidence? International Monetary Fund.

Baccaro, L. and Howell, C. (2017). Trajectories of neoliberal transformation: European industrial relations since the 1970s. Cambridge University Press.

Bowdler, C. and Nunziata, L. (2007). Trade union density and inflation performance: Evidence from OECD panel data. Economica, 74(293), pp.135-159.

Brynjolfsson, E. and McAfee, A. (2013). The great decoupling. New Perspectives Quarterly, 30(1), pp.61-63.

Campolmi, A. and Faia, E. (2011). Labor market institutions and inflation volatility in the euro area. Journal of Economic Dynamics and Control, 35(5), pp.793-812.

Easterly, W. and Fisher, S. (2001), “Inflation and the Poor”, Journal of Money, Credit and Banking, 1, 159-178.

Hung, H.-F., & Thompson, D. (2016). Money supply, class power, and inflation: Monetarism reassessed. American sociological review, 81, 447–466.

Jaumotte, M.F. and Morsy, M.H. (2012). Determinants of inflation in the euro area: The role of labor and product market institutions. International Monetary Fund.

Keune, M., 2021. Inequality between capital and labour and among wage-earners: the role of collective bargaining and trade unions. Transfer: European Review of Labour and Research, 27(1), pp.29-46.

IMF (2023), ‘It’s Never Different: Fiscal Policy Shocks and Inflation’, IMF Working Paper No. 2023/098

OECD (2019) Negotiating our way up: Collective bargaining in a changing world of work.

Sims, C.A. (2011). Stepping on a rake: The role of fiscal policy in the inflation of the 1970s. European Economic Review, 55(1), pp.48-56.

Weber, I.M. and Wasner, E. (2023). Sellers’ inflation, profits and conflict: why can large firms hike prices in an emergency?. Review of Keynesian Economics, 11(2), pp.183-213.